The five major types of accounting are cost accounting, managerial accounting, industrial accounting, private accounting, and corporate accounting. You can become a chartered global management accountant through the American Institute of CPAs and the London-based Chartered Institute of Management Accountants by passing an exam. Managerial accounting involves the use of information that relates to the sales revenue and costs of a company. One part of managerial accounting is cost accounting, which focuses on a firm’s complete production costs.

Advice for future CFOs: One communication skill that sets you apart

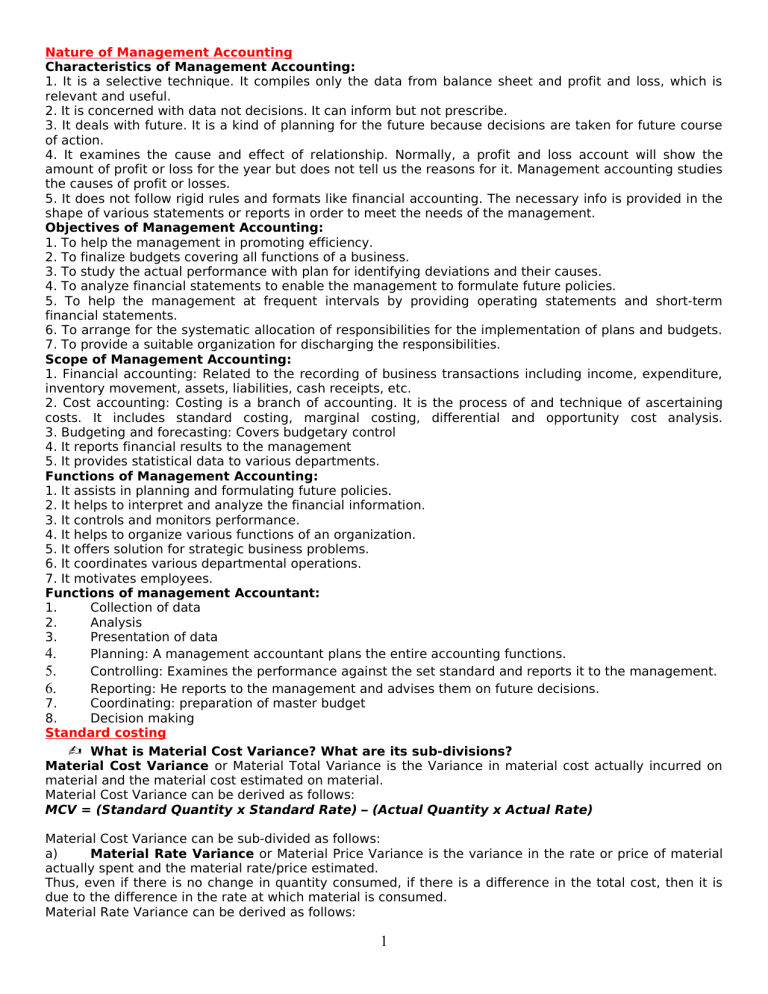

Managerial accounting is the process of identifying and analyzing financial information so that management personnel can make better-informed business decisions. Although the specific underlying details of managerial accounts may vary from one business to the next, they often itemize a company’s spending practices, cash flow streams, debts, and assets. It also aids banks in evaluating whether or not a company is worthy of a business loan. The material covered is completely relevant to current Managerial Accounting thinking. These concepts should not change dramatically, so in terms of concepts the text should remain relevant.

Biggest Accounting Challenges and Solutions in 2024

For instance, the IMA provides that opportunity and also helps professionals create a network for career opportunities, skill enhancement, and decision support. Kuchen adds that devising new systems, business processes, and analyses that save the company money and help it run more efficiently, along with showing an interest in and aptitude for cost accounting, will help you advance. Searle says prospective management accountants should expand their studies beyond those of a traditional financial accountant.

Will Be The ‘Year Of The Management Accountant’

- They tend to focus on their studies in short intense segments between jobs, classes, and family commitments.

- I am happy with the organization of chapters, I could see some re-arrangement.

- Managerial accounting is the process of identifying and analyzing financial information so that management personnel can make better-informed business decisions.

- Management accountants will be at the front and center of this trend, and I believe they are more than ready.

- I observed some unusual omitted spaces, but that was possibly a function of my specific PDF viewer.

This has implications for the way CFOs lead their teams and their organizations into the future. Cultivating resilience and agility must be a priority and soft skills like empathy, active listening, and on-going communication are no longer “nice-to-haves,” but are absolutely critical to unifying organizations. If I had one prediction to make for 2022, it is that there will be more uncertainty and risk.

In detail, our results support the notion that the connection between ethical awareness and the intention to engage in ethically questionable behavior is rather indirect and also mediated by the level of ethical experience, i.e., individuals’ exposure to ethical role models in organizations. In sum, our research study helps to disentangle the ethical decision-making process of professional management accountants and illustrates that ethical environments are necessary to enforce adequate ethical behavior. No doubt, this study has limitations, amongst which are the conceptual framework and the literature review scope.

The outsourcing dilemma: a composite approach to the make or buy decision

The chapter ends with some ideas about how management accounting concepts and information can be useful in this context. Part of that investment will involve the need to upskill finance and accounting staff for new value-added activities that can only be accomplished with the aid of technology. Blackline recently conducted a survey of CFOs to discover what skills gaps they identify among their teams. More than a third (38%) of respondents said that not everyone in their finance team has the broad business leadership knowledge or skills required today. A similar number (35%) indicated that not everyone on their finance team has the skills to help with more strategic work (like analysis and planning).

Building on these, this Section “Future research directions” extends the contribution of this study by specifying core directions for further knowledge development on the contingency perspective of strategic management accounting. Prior literature has documented that perceived uncertainty significantly influences the extent to which firms would embrace strategic management accounting practices (e.g. [49, 58, 70]). According to that foundation, how firms respond from the point of strategic management accounting practices that they would endorse would depend on the nature of environmental uncertainties that surround their operational activities.

They do the work that helps the company’s owner, manager, or board of directors make decisions. Accounting teams that leverage technology are better able to adapt to changes and challenges like some of the unexpected supply chain and revenue interruptions seen in the past few years. Cash flow, hiring new talent, adapting to new tax and regulatory changes and continuing to adjust to remote work remain some of the largest hurdles for what is a perpetual inventory system definition and advantages accounting teams. The text “Managerial Accounting” provides a comprehensive and broad review of the major topics usually covered in an introductory Managerial Accounting course. There is no Table of Contents in the downloadable PDF but a Table of Contents is available at the Open Textbook Library (OTL) webpage where one would download the text. I do use this text in my teaching and I refer students to the OTL Table of Contents.