Such high-risk financing activities can have interest rates as high as 35%, based on research because of the Beginner Debtor Safety Cardiovascular system.

- Email icon

- Facebook icon

- Myspace icon

- Linkedin icon

- Flipboard symbol

- Printing icon

- Resize symbol

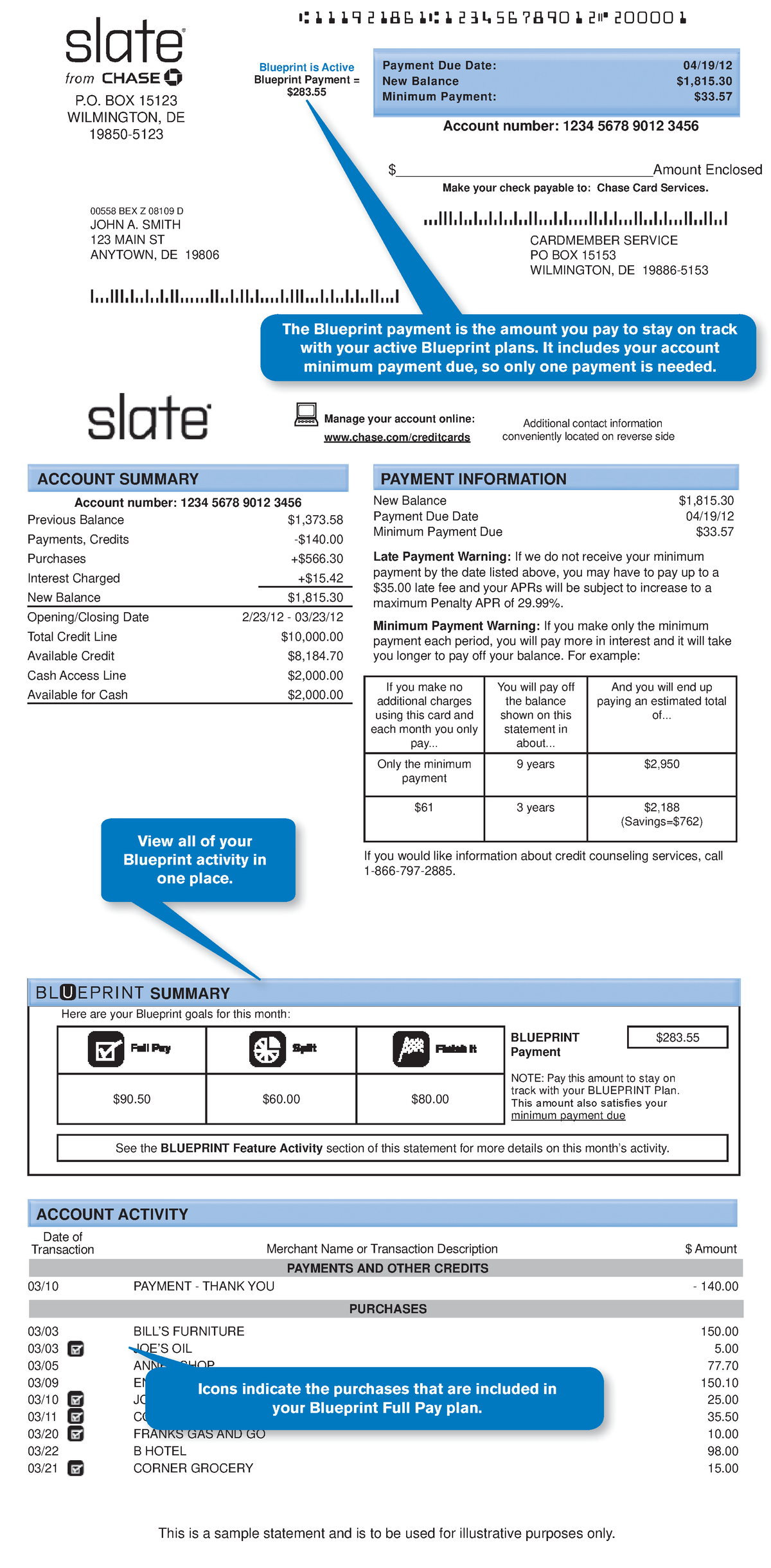

A separate statement features the brand new $5 million 'shadow' scholar loans market. (Photo by Robyn Beck / AFP)

More or less 49 million People in america was coping with $step one.six trillion within the pupil-finance, but one to staggering profile likely underestimates the debt borrowers try providing onto financing their education, another declaration ways.

Over the past years, college students keeps borrowed over $5 mil thanks to an opaque online out-of people to cover education on having-finances universities, new Beginner Debtor Defense Cardio, an enthusiastic advocacy category, discovered. These materials, which aren't old-fashioned federal otherwise personal college loans, will carry higher interest levels or other threats getting borrowers, with regards to the SBPC.

While doing so, giving capital to help you people, it shadow borrowing from the bank program, due to the fact SBPC dubs it, helps to keep applications education college students to own professions for the fields such as for example transportation and you will cosmetology in business - in the event they truly are prohibitively pricey for the majority and do not render graduates with a beneficial credential which is worthwhile on the labor markets.

Which whole bungalow marketplace is allowed to victimize and you can split from the extremely insecure borrowers inside our nation, said Seth Frotman, new administrator manager of your Scholar Debtor Safety Cardio. These participants are foundational to cogs regarding the larger scholar-loans drama, as well as critical elements of what lets predatory schools to survive.

New trace borrowing from the bank system' has grown because High Market meltdown

Whether or not usually out from the social and you can regulatory attention, these items took for the a more common character on the scholar fund landscaping while the Great Recession, according to SBPC's statement. Before, for-profit universities used old-fashioned, private lenders to provide funds so you can children, that have been bundled together with her and you may ended up selling to help you traders. Commonly such money were made so you can college students with little to no respect for whether or not they could pay-off them.

Throughout the years because the overall economy, old-fashioned, private loan providers features lower the wedding from the beginner-mortgage industry generally. Such very-called trace lenders wandered into complete the emptiness for students investment profession degree within for-earnings universities, depending on the statement.

These companies work with schools within the around three trick means, the fresh new report discover. The first is given that an exclusive spouse for students searching for funding. In some cases that may mean development an item to have a particular system or helping a school give to their pupils. The second reason is by providing a different borrowing product that within the some cases schools often promote using the website or educational funding content.

The 3rd was maintenance otherwise gathering on obligations people owe so you can schools for university fees. In these cases, pupils often subscribe an application without paying something at the start, but end due this money having attention. Some of the organizations highlighted in the SBPC report work at colleges to services and you may gather so it obligations, it found.

Steve Gunderson, the principle government officer regarding Profession Studies Colleges Colleges, a trade group symbolizing for-cash colleges, took issue with the newest statement and you may, specifically, the 10-12 months range. He said that by the including the techniques of highest colleges one to have once the shut down, eg Corinthian Universities and you may ITT Technical Institute, brand new report attempts to come across sins of the past and use them to determine and you can explain the new business now.

A multi-age bracket, family-owned college or university in a community will do what they normally to aid the young, the guy told you. In the event the trusted choice is so you can loan currency to college students, might get it done into the best of purposes actually if they lack everything you and i also name an educated regarding tips.

Rates of interest as much as thirty-five%

These products showcased from the SBPC are given by the at the least 12 type of people and you will bring many threats to own individuals, the report found. In many cases, interest levels is all the way to thirty-five%. In others, they hold charges which are not normal regarding federal and personal student loan situations.

However, they aren't simply high priced; these items lay individuals at stake in other ways. One to lender, TFC Tuition Capital, promotes in order to medical schools trying to find the financing program you to a beneficial borrower's certification cash loan Ophir are recinded if there is default, the brand new declaration discover. TFC didn't quickly respond to an ask for discuss the new report.

On the other hand, particular facts require you to definitely borrowers be rejected by the other financial ahead of being qualified; anybody else advertise that they can offer resource in place of a credit assessment or underwriting.

Meanwhile on universities, products enable it to be a method to bypass regulation, the brand new report discover. To possess universities one rely on federal financial aid, these materials can help her or him follow the latest regulation, a rule that requires colleges receiving government school funding to track down at least 10% of the money from a source apart from the fresh new government's college student financing system. Of the coping with this type of opaque lenders, schools can make their unique lending programs that college students can use to invest in university fees, and that try not to number on the latest 90% restrict to your government financial aid financial support.

To own programs that aren't qualified, and that are unable to take part in new government education loan system, these things give a supply of funding for students just who wouldn't if you don't manage to spend the money for software and a supply of cash for the schools.

The brand new declaration urges governing bodies in the certain profile for taking a better see these businesses, together with by the requiring them to sign up to state regulators and by performing a federal registry of all of the nonbank economic properties companies, including those individuals showcased regarding report.