- Having Sales step 1.00% initial paid to the mortgage loan count

- To own Refinancing 1.00% initial paid to the real estate loan matter

- For all Financing 0.35% yearly fee that is based on the remaining dominating balance out-of the entire year

Example Good homebuyer having good $one hundred,100000 mortgage could have good $1,000 initial financial insurance rates pricing and you will a payment out of $ for the yearly financial insurance policies.

It might be set in the mortgage equilibrium of one's borrower to expend over the years. USDA financial insurance coverage usually are lower than home loan insurance coverage from conventional and FHA fund. FHA mortgage insurance costs is a-1.75% upfront top and 0.85% into yearly mortgage insurance. Concurrently, conventional loan individual financial insurance premiums (PMI) are different but could become above step one% a-year. Which have a good USDA mortgage, the mortgage advanced is merely a portion of what you usually usually shell out. USDA home loan cost are quite reduced immediately.

USDA home loan rates are a minimal compared to the FHA, Virtual assistant, and you may antique financial cost when the customer is to make a tiny otherwise lowest advance payment. To have good homebuyer with the common credit history, USDA real estate loan prices will be a hundred base circumstances (1.00%) or more underneath the cost away from old-fashioned funds. Down prices equal lower mortgage repayments every month that's the reason USDA fund could be extremely sensible.

Towards USDA Rural Property Home loan

The full name of Outlying Innovation Financing are USDA Rural Innovation Guaranteed Property Financing. Nevertheless the program can often be labeled as USDA Mortgage Program. The newest USDA mortgage system is known as a great Part 502 mortgage in certain cases. The reason being they identifies point (502)h of your Houses Work of 1949 that makes the entire program you'll. This method is designed to let solitary-house buyers and trigger growth in rural and you will reduced-income elements. While it may seem some limiting, more 97% of United states chart is approved to own USDA loans this can include suburban section and you may major cities. Instance, any area that a people out-of 20,100 otherwise faster is approved (35,100000 otherwise shorter in some special circumstances).

Most homeowners also whoever has USDA real estate loan eligibility have not observed the brand new USDA financing system or discover really absolutely nothing about it. As the USDA mortgage system was launched throughout the 90s, it actually was up-to-date and you can adjusted to help you interest outlying and you may suburban buyers countrywide merely has just. Most USDA-recognized lenders on the loan application menu but render it anyhow. If you feel you are qualified to receive a zero-down USDA mortgage, you will want to inquire the lending company whether they provide the program.

USDA Mortgage Qualified Geographic Elements

Currently, if you wish to purchase a house, you would not come across of many finance that don't wanted an all the way down fee. Actually, merely Va and you may USDA money create individuals buy homes without a down-payment. To help you be eligible for an excellent Virtual assistant loan, you must be a member of new army. Although not, to help you qualify for new USDA financing, your local area 's the main factor considered.

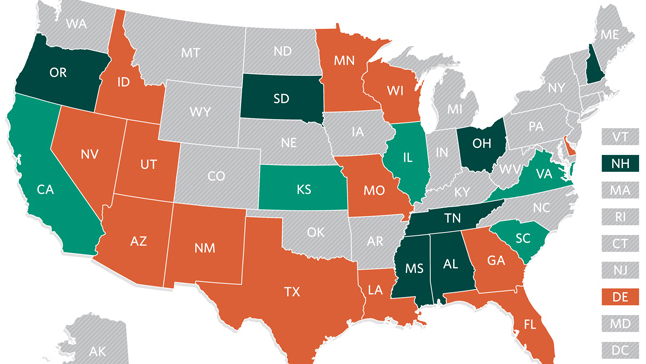

USDA funds are built to allow financial growth in the fresh shorter-heavy (rural) regions of the newest You.S. Keep in mind that USDA loans also are also known as RD or outlying invention funds. Because the considering throughout the USDA qualification charts, you could use only the mortgage in this specific places.

Geographical Qualification to possess a good USDA Financial

You can examine your area for the USDA Qualifications Chart so you can see if they qualifies having a beneficial USDA Financial. Particular says are completely eligible, eg Wyoming. Remember that, at the very least 97% of your U.S residential property size is installment loan Oakwood IL eligible for the loan, regarding the 109 million somebody. Certain residential district parts meet the requirements just like the charts have not been updated having a bit nevertheless have to get the loan in advance of the brand new boundaries transform.