![]()

All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional. Any rust that slowed the Georgetown men’s basketball team Saturday was completely understandable. The capability of financial information to influence the decision-making process by providing pertinent information related to economic decisions. I have also noticed a big gap between “Add-to-Cart” and “Reached Check Out” rate to actual sales on our site, which is understandable and unavoidable in uncertain times like these. Given that no amount of social protest is going to dent Rowling’s bank account, perhaps it’s understandable, then, to consider a pragmatic response to a new Harry Potter series.

Why is ‘-ed’ sometimes pronounced at the end of a word?

This is entirely understandable—after all, it is unsettling that a physician could make such an obvious mistake. Certainly, this response would be understandable and even justified if de Blasio had in fact attacked the police. With the addition of Cade Cunningham, the top recruit in the country according to 247Sports, it was an extremely understandable position to take now. These are understandable errors for any scribe, but not for the author of the work, to make. And his understandable expressions of regret—now that his book is tanking—come as too little, too late. The point of these exercises is to make centuries-old texts relatable; their characters understandable.

understandable

The preceding concepts do not mean that complex information should be excluded from the financial statements. For example, the concepts related to pensions and derivatives are not easy to understand. In these situations, apply the understandability concept as much as possible, but still present the required information. These areas often require explanation with appropriate disclosure notes, along with the basis for their calculation. Perhaps elsewhere and under more suitable circumstances I may be able to put my thought into words, precise and understandable. When assembled in the form of intelligent reports, these statistics present an understandable history of the business.

Other Words From

The understandability concept basically suggests that the financial statements prepared must be clear and explicit for their users. The information in the financial statements must be presented in such a way that the users do not get confused or deluded. where’s my refund This does not mean that complex data must be excluded from these statements, but this data must be explained enough so that even the users possessing considerably less accounting or business knowledge could understand and interpret it easily.

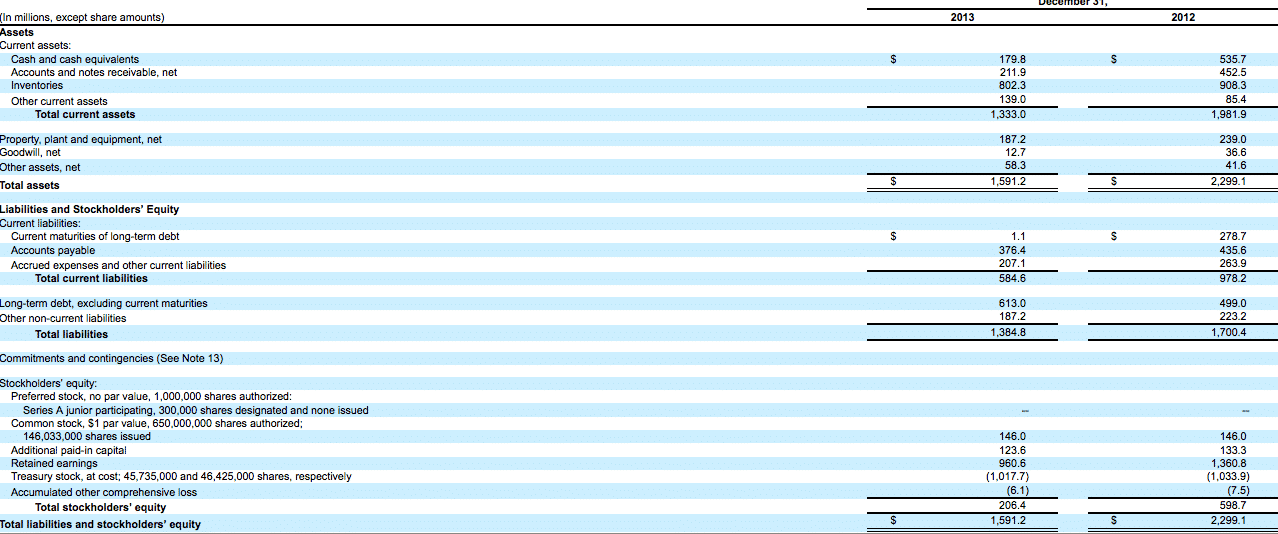

On the basis of these statements, they also predict the company’s future performance and make decisions about their connection with the company. The understandability concept of accounting states that the information communicated by a company through its financial statements and related notes should be easily understandable to its readers. This concept bears much importance because difficulties in understanding the financial statements may seriously impact the decision-making of investors and other stakeholders of the company. Understandability refers to the quality of accounting information that makes it comprehensible to users who have a reasonable knowledge of business and economic activities. It emphasizes the importance of clarity and simplicity in financial reports, ensuring that information is presented in a way that allows users to make informed decisions without excessive effort or confusion.

Word Length

- This concept assumes a reasonable knowledge of business by the reader, but does not require advanced business knowledge to gain a high level of comprehension.

- These areas often require explanation with appropriate disclosure notes, along with the basis for their calculation.

- It emphasizes the importance of clarity and simplicity in financial reports, ensuring that information is presented in a way that allows users to make informed decisions without excessive effort or confusion.

- The information in the financial statements must be presented in such a way that the users do not get confused or deluded.

- The preceding concepts do not mean that complex information should be excluded from the financial statements.

Adherence to a reasonable level of understandability would prevent an organization from deliberately obfuscating financial information in order to mislead users of its financial statements. For example, it promotes attributes like comparability and consistency within financial statements. Companies mostly run their operations with the help of funds provided by shareholders and creditors, who expect a reasonable return on their investment. They are therefore also responsible for preparing the company’s financial statements at regular intervals. Financial statements are the primary source of information for investors to review how directors and managers have performed to meet their goals during a particular period.

Additionally, too much use of jargon must be avoided, and where possible, intricate terms and statements must be substituted with general or easy-to-understand language. The use of proper headings, graphs, formats, etc. can also make the statements more legible and useful for their users. Understandability is the concept that financial information should be presented so that a reader can easily comprehend it. This concept assumes a reasonable knowledge of business by the reader, but does not require advanced business knowledge to gain a high level of comprehension.