Accounts payable (AP) are considered liabilities and not expenses. Because accounts payables are expenses you have incurred but not yet paid for. The bank account is a real account but not a personal or nominal one. Maintaining accounts time-to-time helps business personnel in quick decision-making accounts help them to analyze the transactions regarding their expenses, benefits, and losses.

Super Micro Bosses Face New Investor Suit Over Accounting Woes

Cost accounting is a process of recording, summarizing, analyzing, and allocating the cost over the process of manufacturing a product or providing services. The accounting ledger is a chronological listing of all financial transactions of a business, in date order. An example of an Expense account would be a typical business expense, such as your rent payment on a physical business location.

- If you’ve been a business owner for any length of time, you’ve probably seen a wide variety of different accounts or sub-accounts, which can vary wildly.

- A few examples of real accounts are facets of business like cash, land plant, and machinery, examples of personal accounts are like Preeti, Pankaj examples of nominal accounts are like salaries, wages, sales, and purchase.

- A COA is where you organize the various accounts used in your business.

- As a business owner, it’s essential that you understand the differences between these types of accounts.

The Chart of Accounts

One of the main objectives of Accounting is to provide the information for filling up the tax every year. Returns-of-income tax, wealth tax, sales tax, GST, etc should be taken into consideration. For more information about accounting, we can also see the vedantu website and app which provide study materials having full clarity about each concept. Students can also prepare for the examinations from practice questions.

Financial Accounting

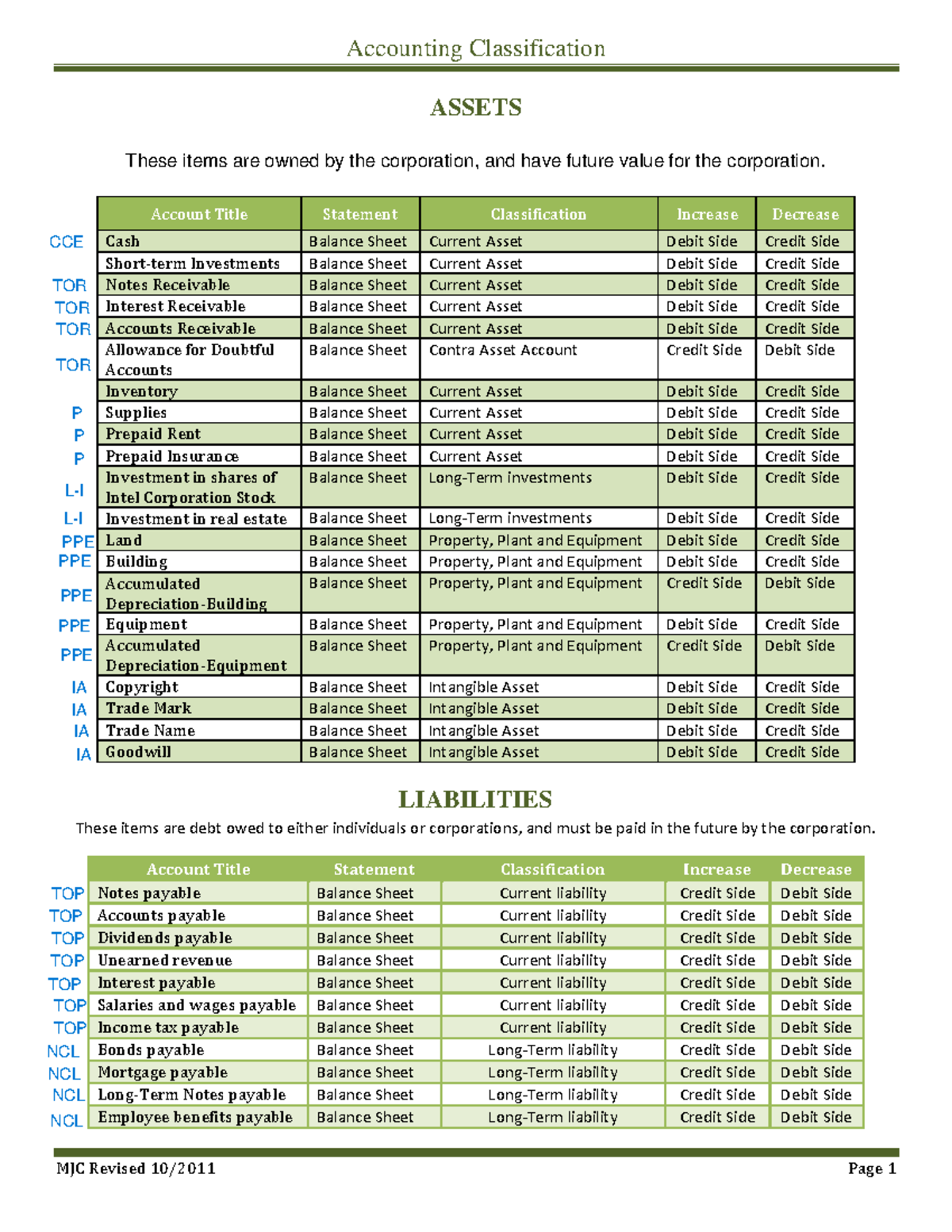

Generally, businesses list their accounts by creating a chart of accounts (COA). A chart of accounts lets you organize your account types, number each account, and easily locate transaction information. Some accounts are used to offset other accounts known as contra accounts. First, the executives access the information of financial accounting followed by the cost accounting. There are several data analysis processes they carry out to extract the necessary data. The goal of accounting is to collect data and to prepare reports on financial statements, about the performance of the firm, whether it is running smoothly, its financial situation, and the cash flows of a business.

In sole proprietorship, a single capital account titled as owner’s capital account or simply capital account is used. In partnership or firm, each partner has a separate capital account like John’s capital account, Peter’s capital account etc. In corporate form of business there are many owners known as stockholders or shareholders and the title capital stock account is used to record any change in the capital. For the purpose of applicability of Accounting Standards, Non-company entities are classified into two categories, viz., Micro, Small and Medium Sized Entities (MSMEs) and Large entities.

Why You Can Trust Finance Strategists

An account related to any individual like David, George, Ram, or Shyam iscalled as a Natural Personal Account. By taking all these things in consideration decisions are made for the progress of the firm. They not only help to manage the business of the firm but also to make future decisions like to invest more money in it or lend money can law firms measure ambition without billable hours etc. There are mainly three subfields of accounting, such as Cost Accounting, Management Accounting, and Financial Accounting. Type – Cash A/c is a Real account, Discount Allowed A/c is a Nominal account, and Unreal Co. The entry acts as a counterweight and is made to reverse or offset an entry on the other side of an account.

Your company’s expenses are anything you purchase to run your business. When you buy fuel for your company vehicle or stock up on office supplies, those purchases are considered company expenses and you need accounts involved in that. Moreover, every sub-account you use allows you to keep track of your spending more accurately. When combined with accounting software like FreshBooks, managing your business is easier than ever.

Simply put, a chart of accounts (or COA) is an organizational tool that provides financial oversight of all of a business’s transactions and accounts. A few examples of real accounts are facets of business like cash, land plant, and machinery, examples of personal accounts are like Preeti, Pankaj examples of nominal accounts are like salaries, wages, sales, and purchase. The chart of accounts is a key part of converting ledgers into financial statements. The chart is a list of all the accounts used in the general ledger, identifying each account by number. Your accounting software uses the chart to identify the accounts such as revenue, common stock, cash and depreciation that must be included in making up the balance sheet. Did you know that there are several types of accounts in accounting?