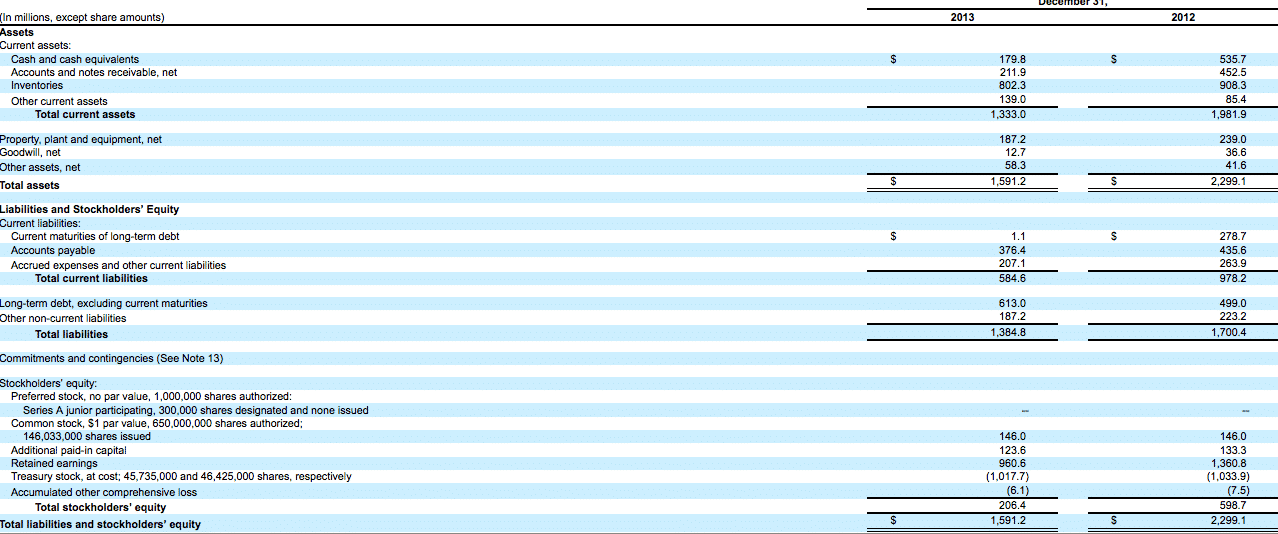

Analysts and investors compare the current assets of a company to its current liabilities. The D/E ratio of a company can be calculated by dividing its total liabilities by its total shareholder equity. It shows the proportion to which a company is able to finance its operations via debt rather than its own resources. It is also a long-term risk assessment of the capital structure of a company and provides insight over time into its growth strategy.

Role of Debt-to-Equity Ratio in Company Profitability

It’s also important to note that interest rate trends over time affect borrowing decisions, as low rates make debt financing more attractive. Additional factors to take into consideration include a company’s access to capital and why they may want to use debt versus equity for financing, such as for tax incentives. Put another way, if a company was liquidated and all of its debts were paid off, the remaining cash would be the total shareholders’ equity. In most cases, liabilities are classified as short-term, long-term, and other liabilities.

Step 1: Identify Total Debt

Another leverage ratio concerned with interest payments is the interest coverage ratio. One problem with only reviewing the total debt liabilities for a company is that they do not tell you anything about the company’s ability to service the debt. A leverage ratio is a type of financial measurement used in finance, business, and economics to evaluate the level of debt relative to another financial metric. It can be used to measure how much capital comes in the form of debt (loans) or assess the ability of a company to meet its financial obligations. The debt-to-equity ratio (D/E) measures the amount of liability or debt on a company’s balance sheet relative to the amount of shareholders’ equity on the balance sheet. D/E calculates the amount of leverage a company has, and the higher liabilities are relative to shareholders’ equity, the more leveraged the company is.

Excel Formula for Debt-to-Equity Ratio

However, these balance sheet items might include elements that are not traditionally classified as debt or equity, such as loans or assets. A decrease in the D/E ratio indicates that a company is becoming less leveraged and is using less debt to finance its operations. This usually signifies that a company is in good financial health and is generating enough cash flow to cover its debts. This ratio helps indicate whether a company has the ability to make interest payments on its debt, dividing earnings before interest and taxes (EBIT) by total interest.

- Banks also tend to have a lot of fixed assets in the form of nationwide branch locations.

- This team of experts helps Finance Strategists maintain the highest level of accuracy and professionalism possible.

- A negative debt-to-equity ratio would also not be meaningful because it would indicate that the company has more debt than equity, which is not possible.

- A debt-to-equity-ratio that’s high compared to others in a company’s given industry may indicate that that company is overleveraged and in a precarious position.

- High leverage ratios in slow-growth industries with stable income represent an efficient use of capital.

The debt-to-EBITDA leverage ratio measures the amount of income generated and available to pay down debt before a company accounts for interest, taxes, depreciation, and amortization expenses. This ratio, which is commonly used by credit agencies and is calculated by dividing short- and long-term debt by EBITDA, determines the probability of defaulting on issued debt. In most cases, leverage ratios assess the ability of a company, institution, or individual to meet their financial obligations. For example, too much debt can be dangerous for a company and its investors. However, if a company’s operations can generate a higher rate of return than the interest rate on its loans, then the debt may help to fuel growth.

For startups, the ratio may not be as informative because they often operate at a loss initially. If you want to express it as a percentage, you must multiply the result by 100%. Overall, the D/E ratio provides insights highly useful to investors, but it’s important to look at the full picture when considering investment opportunities. Banks also tend to have a lot of fixed assets in the form of nationwide branch locations. The investor has not accounted for the fact that the utility company receives a consistent and durable stream of income, so is likely able to afford its debt. While a useful metric, there are a few limitations of the debt-to-equity ratio.

Companies in some industries, such as utilities, consumer staples, and banking, typically have relatively high D/E ratios. Times interest earned (TIE), also known as a fixed-charge coverage ratio, is a variation of the interest coverage ratio. This leverage ratio attempts to highlight cash flow relative to interest xero makes toronto office its north american hub owed on long-term liabilities. This ratio is used to evaluate a firm’s financial structure and how it is financing operations. Generally, the higher the debt-to-capital ratio, the higher the risk of default. If the ratio is very high, earnings may not be enough to cover the cost of debts and liabilities.

The D/E ratio is a powerful indicator of a company’s financial stability and risk profile. It reflects the relative proportions of debt and equity a company uses to finance its assets and operations. For instance, utility companies often exhibit high D/E ratios due to their capital-intensive nature and steady income streams. These companies frequently borrow extensively, given their stable returns, making high leverage ratios a common and efficient use of capital in this slow-growth sector. Similarly, companies in the consumer staples industry tend to show higher D/E ratios for comparable reasons. An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations.

The underlying principle generally assumes that some leverage is good, but that too much places an organization at risk. Average values for the ratio can be found in our industry benchmarking reference book – debt-to-equity ratio. Inflation can erode the real value of debt, potentially making a company appear less leveraged than it actually is. It’s crucial to consider the economic environment when interpreting the ratio. This result indicates that XYZ Corp has $3.00 of debt for every dollar of equity. The other important context here is that utility companies are often natural monopolies.

One limitation of the D/E ratio is that the number does not provide a definitive assessment of a company. In other words, the ratio alone is not enough to assess the entire risk profile. These can include industry averages, the S&P 500 average, or the D/E ratio of a competitor.

It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering. The debt-to-equity ratio (D/E) is calculated by dividing the total debt balance by the total equity balance. By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in a liquidation scenario. Lenders and debt investors prefer lower D/E ratios as that implies there is less reliance on debt financing to fund operations – i.e. working capital requirements such as the purchase of inventory.